This article originally appeared in the May/June 2020 issue of the Ontario Medical Review magazine.

Young, healthy, single and just starting out? Time to get serious about insurance

Maybe you’re in your 30s and haven’t started a family or bought a home yet, although those goals are on your radar. With loans to pay off, money might be tight, at least until you get established. Or perhaps you are starting residency or are in the early years of setting up your practice, with the long hours and heavy demands that brings.

Insuring yourself from personal and professional risks is probably one of the furthest things from your mind. When it comes to insurance, wouldn’t it make more sense to wait until you’re more established, with a house and family to think about?

As self-employed professionals, most physicians do not have access to group medical benefits, such as disability and life insurance, and dental and medical coverage. It’s never too early to familiarize yourself with the inexpensive, basic coverage available to you as a medical student, resident or young doctor. Insuring yourself while you’re still young and healthy could also save you considerable time, money and stress later in life. So before you go back to your studies, rounds or patients, think of this article as a call to action to put your well-being and finances first.

Preya Singh-Cushnie, Director of Insurance Advisory and Education for OMA Insurance, agrees that insurance isn’t always top-of-mind for young doctors.

“I don’t think anyone goes into their first year of medical school thinking about insurance,” says Singh-Cushnie. “Some are married or just starting a family, but the majority are single, engaged, or married with no kids. They may not know that insurance is more affordable when they’re younger.

“You’re more than likely to get approved at a lower cost. You can adapt your coverage as you get older. The important thing is to have it in place when you’re young and healthy. Keep in mind that it will also be cheaper over your lifetime.

“We also have international medical students who come to the province to complete their medical studies, who tend to be a little older and have a family. They’re inspired to get life insurance because they have personal and professional obligations.”

Obviously, physicians aren’t invulnerable. A serious accident, injury or illness can delay finishing medical school studies or temporarily sideline a career.

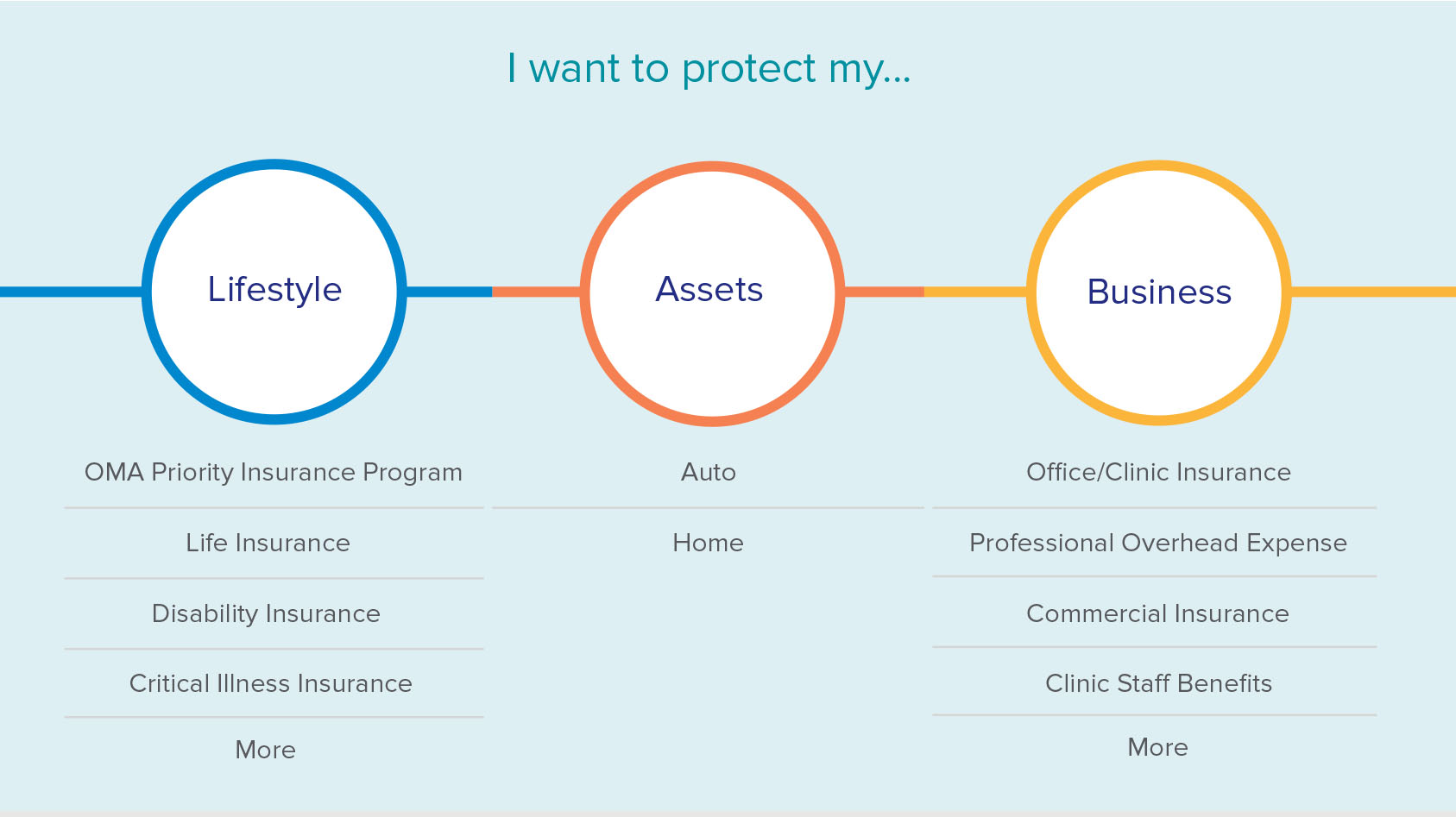

That’s why the Ontario Medical Association has set up a range of insurance coverage, easily available through an OMA Insurance advisor or online, and all specifically designed to help medical students and young doctors protect themselves and their careers.

To make the process as convenient as possible, OMA Insurance offers insurance bundles that cost far less than obtaining individual coverage through a third-party insurer.

As Singh-Cushnie points out, “With OMA Insurance, you’re participating in the power of a buying group where we have an 80 per cent participation rate (the percentage of members insured through OMA Insurance). Because of that power, we’re able to offer these bundled insurance solutions at a competitive price.”

Getting insured in your 20s or 30s makes sense, both in terms of cost savings and peace of mind. Depending on what the future may brings – for example, a car accident, cancer diagnosis, the onset of a chronic disease – the value of that low-cost coverage to a physician’s well-being, family life and career could prove to be very beneficial.

For example, with the Student Special Offer available through OMA, medical students can enrol online for bundled disability and life insurance at a very low cost with no underwriting. Acceptance is automatic, with no medical questions. The Student Special Offer includes two types of coverage: Disability Insurance at a discounted rate, and $100,000 in complimentary Life Insurance. Let’s look at why each type of coverage is important.

Discount Disability Insurance provides you with tax-free monthly income if, for example, you had to put medical school on hold due to a major illness or injury. Disability Insurance provides you with the money (and therefore the time) to recover, without worrying about finances: your insurance benefit can help cover your bills, living expenses and medical costs over and above those covered by provincial health insurance. Disability Insurance could help you get back on your feet and back to your studies without having to worry about looking after dependents. If you keep the coverage throughout your medical studies, it’s free in year four. Your disability benefits increase automatically as you proceed from medical school to residency.

With the OMA bundle, medical students also receive $100,000 in complimentary Life Insurance. This coverage costs you nothing because OMA Insurance pays the premiums on your behalf while you’re a student, with an option to keep your coverage after you’ve graduated. It’s good to know that if something did happen to you, your beneficiary – the person you choose to receive the payment – would receive $100,000 tax-free to settle your debts. Your beneficiary could be your partner, spouse, friend or even your parent or grandparent – possibly someone supporting you financially during medical school. You can change your beneficiary any time, as your life changes.

If you take advantage of the Special Student Offer, when you graduate your Disability Insurance and Life Insurance will automatically follow you into your residency and practice. Although the cost will rise slightly, you will still get a discount through OMA. Most importantly, you will continue to be covered at every stage of your career, even if you do nothing further to insure yourself.

The Essentials program is a one-stop insurance bundle that gives you the basic coverage most physicians need at the next stage of their careers. You have a choice of Life Insurance, Disability Insurance, and/or Professional Overhead Expense (POE) Insurance.

Think of POE Insurance as disability insurance that covers the cost of running your practice if you couldn’t work because of a serious illness or injury. POE Insurance provides money to cover utility payments, mortgage, and employee salaries, so you can keep the practice running while you take time to recover.

Again, there’s no medical examination required to enrol in the Essentials program if you enrol within 120 days of receiving the offer, and the cost is significantly lower than insuring yourself through an individual third-party plan. That’s because, through OMA Insurance, you’re taking advantage of being part of a group that can work together to offer you better rates.

With insurance companies seeing rising numbers of claims due to floods and other events linked to climate change, you may want to consider Office Clinic Insurance. Should your premises be damaged, this insurance can help you continue to treat patients while you rebuild and repair your offices.

Another rising area of concern is the security of electronic medical records (EMRs). Doctors’ offices may not be the first place you think of as vulnerable to cyber criminals, but well-publicized recent data breaches have shown that medical records are a key target of hackers and scammers.

Many physicians are unaware that they are legally responsible for protecting the security and confidentiality of online electronic patient records and could face penalties if their patients’ data is breached. Low-cost Cyber Liability Insurance mitigates the financial risks of a breach and can provide legal advice and other services in the aftermath of an incident.

Along with specialized coverage for medical students and physicians, the OMA’s Home and Auto Insurance Program gives you access to home and auto insurance that you can easily set up through an OMA Insurance advisor or online. Even if you don’t yet own a home, you can insure your belongings inside a rental unit against theft, fire, and other types of damage with tenant insurance.

The OMA Priority Insurance Program (OPIP) provides members with medical and dental coverage through OMA Insurance. OPIP is designed to give Ontario physicians access to the type of benefits that many Ontarians receive as part of an employee benefits program. Dental coverage – even something as basic as a check-up and cleaning – can cost hundreds of dollars in a single visit. Prescription drug costs are on the rise. And out-of-province and country travel insurance is a must-have, even if you’re just crossing the border for the day. OPIP is available to you when you become a newly practicing physician, and can stay with you throughout the span of your career. You can cover your immediate family too.

Medical school may seem too early to start saving for retirement. But in fact, the impact of compound interest means that you could potentially earn significantly more on small amounts invested in your 20s and 30s, versus larger investments 10 or 20 years later. A simple way to get started is with the Advantages Retirement Plan™.

With physicians living and working longer, and retiring later than the average Canadian, it’s important to make a habit of saving for your goals. Given that most physicians don’t have access to a high-quality group retirement plan, the Advantages Retirement Plan™ provides an easy, low-cost way to start saving for your retirement.

You can start with as little as $100 a month. If you need to take a break from contributions, you can put the program on hold and start up again later. Advantages offers a great way to get into the habit of paying yourself first, without having to invest a lot of time and money into the process.

Insurance and retirement may seem like a lot to think about right now. The important thing is to take a few first steps and get into the habit of protecting and investing in yourself as your life and career change.

Insurance is about having options. As a physician, you are likely focused on day-to-day practice. But you have to look after yourself too – and one day, perhaps a family and a practice. Getting into the habit of covering yourself from risks is a healthy habit, especially when coverage is so inexpensive and easy to obtain through an OMA Insurance advisor or online.

OMA Insurance has made the process easy and convenient. Need help? OMA Insurance advisors are always happy to talk to you about your needs as your life and career evolve.

For more details about OMA Insurance solutions that protect you and your practice, visit the OMA Insurance website, or call 1.800.758.1641 to speak to an OMA Insurance advisor.